Natural Gas Supply

Natural Gas Solutions

We provide tailored natural gas supply strategies designed to help your business manage expenses and optimize your gas savings.

Gas Rate Choices

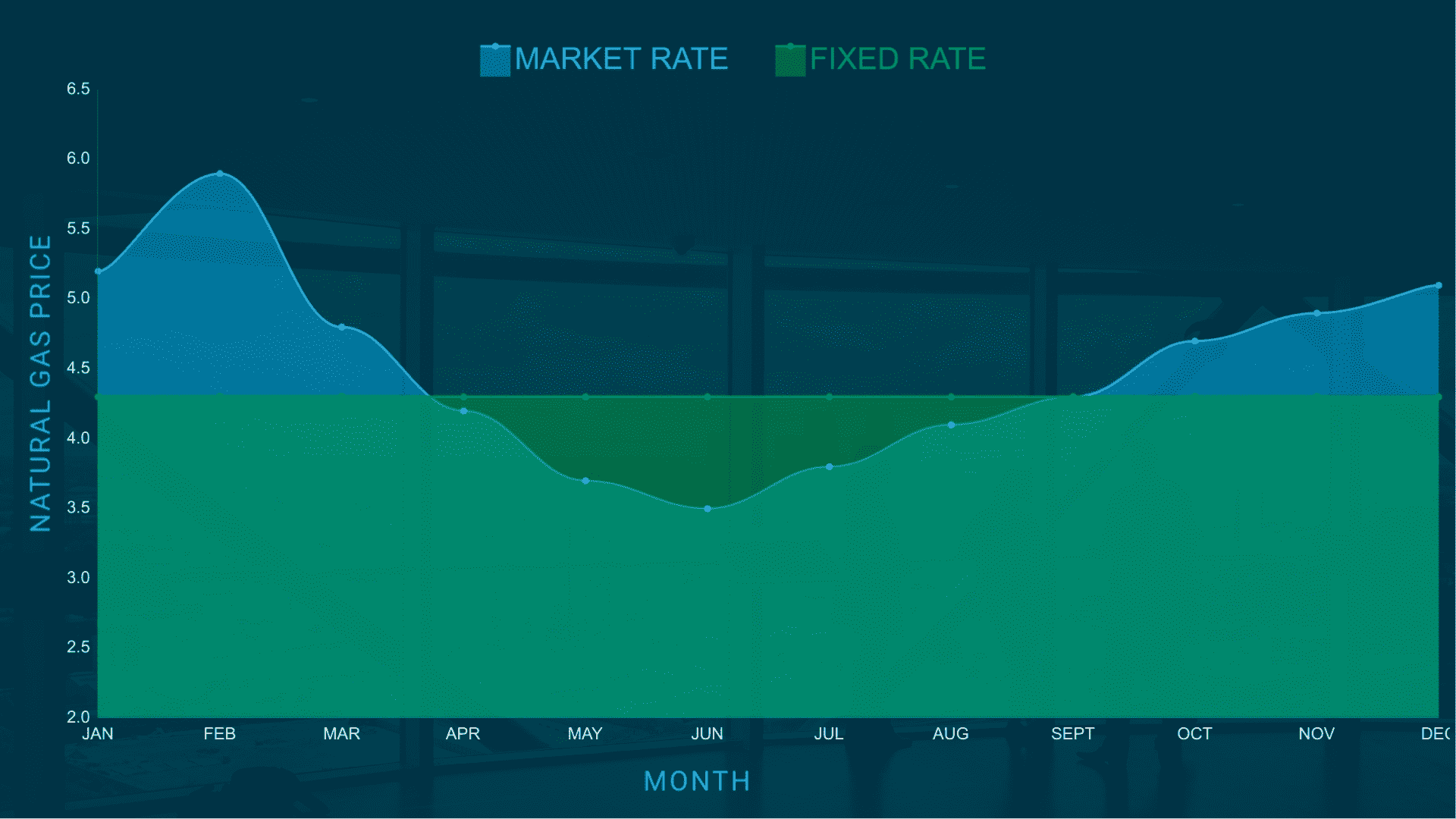

Fixed Rates

A fixed-rate natural gas plan offers businesses a dependable solution for managing their energy budgets. In deregulated markets where natural gas prices can shift with market dynamics, a fixed rate ensures stable pricing over the life of the contract. This consistency allows companies to forecast expenses more accurately, aiding in both financial planning and long-term strategy.

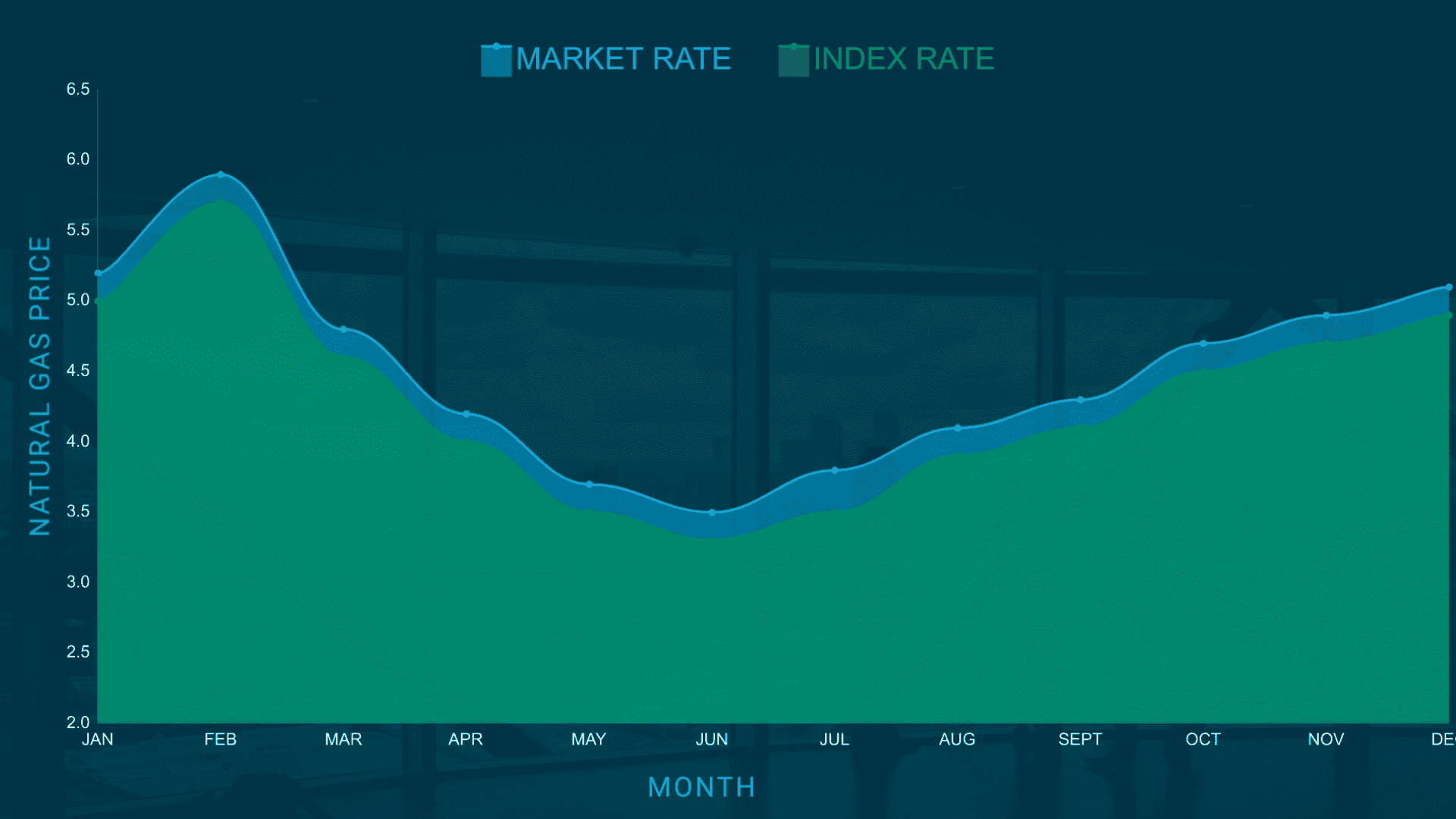

Index Rates

An index-based natural gas plan offers businesses the opportunity to capitalize on market-driven price fluctuations, particularly during periods of lower NYMEX pricing. Unlike fixed-rate contracts, index rates adjust with the natural gas market, allowing customers to benefit from potential cost reductions when prices decline. This approach can lead to significant savings in favorable market conditions. However, choosing between index and fixed pricing depends on your company’s risk profile and appetite for market variability.

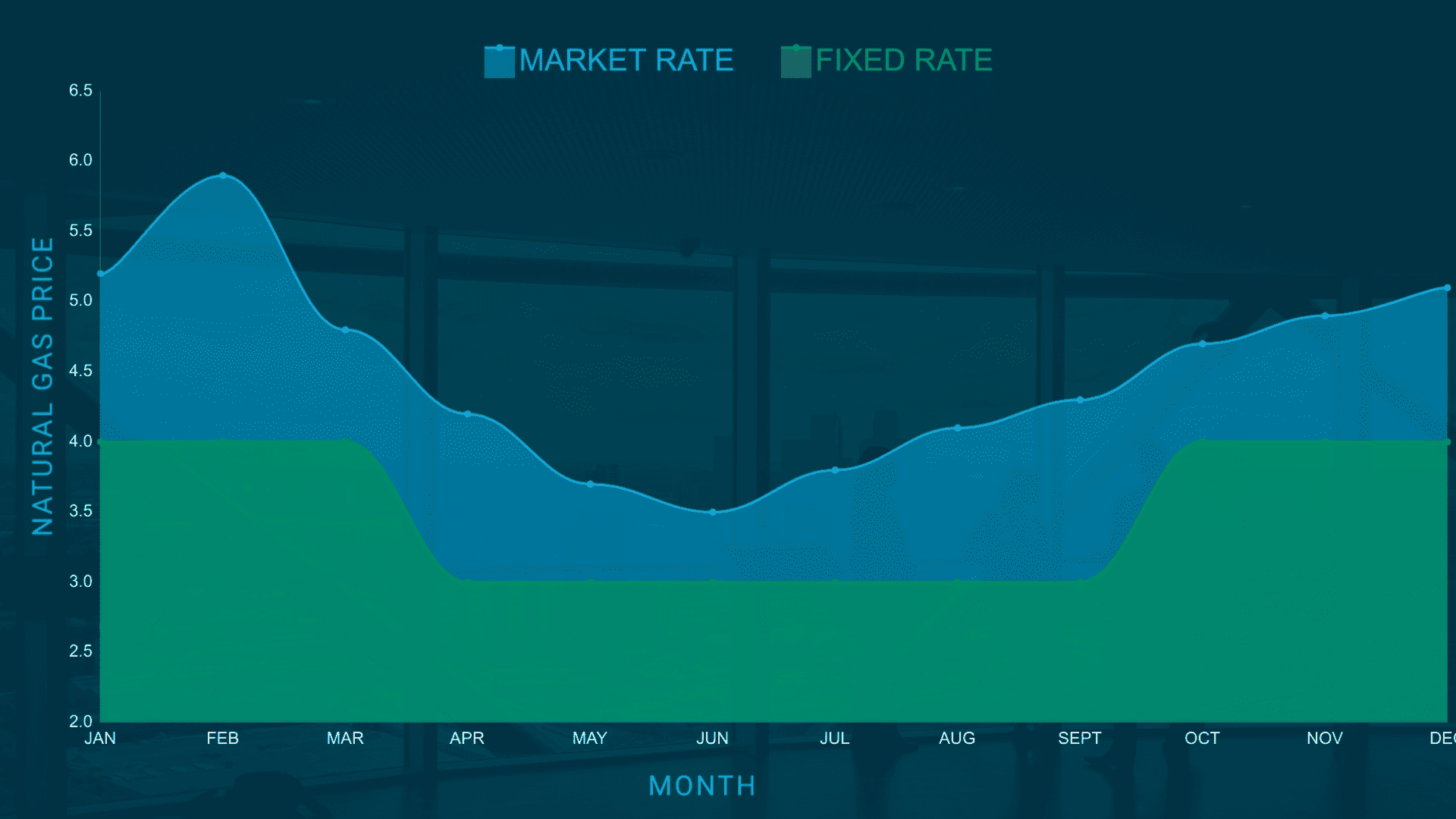

Fixed + Index Rates

Fixed + index natural gas rate plans offer a hybrid pricing strategy that combines the stability of fixed rates with the flexibility of market-based pricing. This blended approach allows businesses to hedge a portion of their usage at a predetermined rate, ensuring predictable costs for part of their energy needs. At the same time, the index-based portion of the plan enables companies to take advantage of favorable market conditions when prices fall. This structure is ideal for organizations seeking a balance between budget certainty and potential savings.

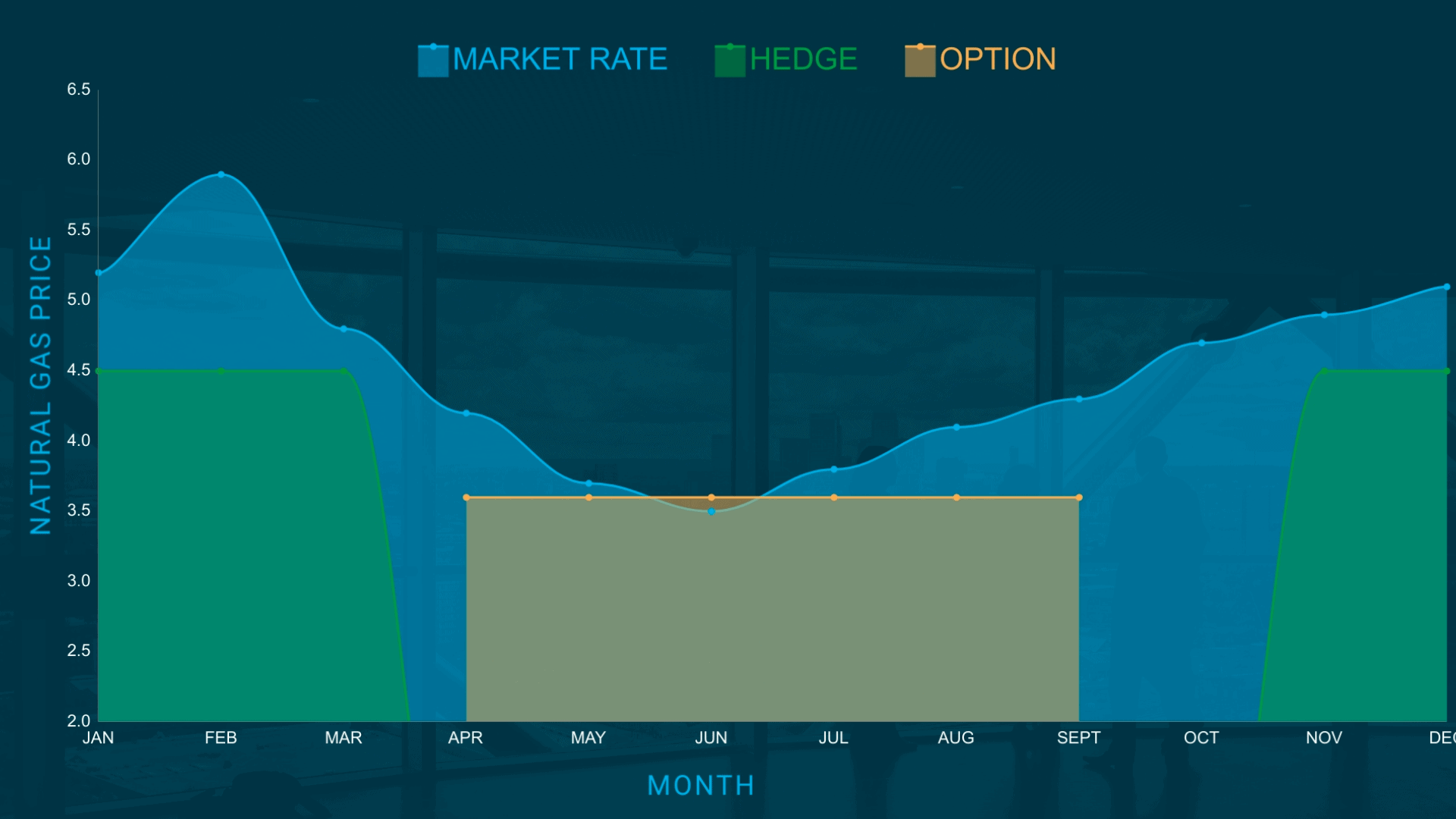

Custom Hedging

Commercial entities can take greater control of their natural gas expenses by utilizing advanced financial instruments such as options, collars, and hedges. Options give businesses the right, but not the obligation, to buy gas at a predetermined price, providing a safeguard against unexpected price spikes. Collars create a price floor and ceiling, capping potential losses while preserving some upside if prices fall. Hedging strategies, meanwhile, enable companies to lock in pricing for future gas usage, delivering stability and aiding long-term financial planning. Together, these tools help mitigate exposure to volatility in the natural gas markets and support smarter energy procurement decisions.

Our Gas Services

As a full-service natural gas brokerage, we support businesses operating in deregulated markets with expert guidance and tailored solutions. Licensed in every deregulated state, we provide complete brokerage services from procurement to ongoing contract support. If you’re seeking a single, reliable source for managing your natural gas supply needs, Power Choice Solutions is here to help. From evaluating rates to monitoring your bills, we simplify the entire process and help you manage your energy costs with confidence.

Rate Analysis

We evaluate your exiting natural gas rates to determine if there is an opportunity to save money on your bill.

Supplier Vetting

We send out RFPs on your behalf to the nation's leading natural gas suppliers and vet price quotes.

Negotiation

Our team utilizes our decades of energy experience to negotiate favorable contract terms that you desire.

Management

Our customers enter into our ongoing market and rate monitoring programs to ensure future savings.

We are trusted by some of the nation’s leading brands:

Get a Free Consultation

Our team brings over a century of combined experience in both retail and wholesale energy markets. Get in touch with us today to explore a customized energy strategy tailored to your business needs.

Gas Supply Solutions

Every business utilizes natural gas differently based on its operations and energy demands. By aligning natural gas supply strategies with your specific consumption patterns, you can unlock meaningful cost savings. We specialize in delivering tailored natural gas procurement solutions. Here are several supply options we provide to support your energy goals.

Fixed-Rate Natural Gas Plans

Great for those looking for long-term certainty.

Fixed-rate natural gas plans are a popular choice for commercial customers in deregulated markets. These plans offer a simple and reliable way to lock in natural gas costs over a defined contract period. Unlike index-based pricing, fixed rates are insulated from market volatility, providing predictable energy expenses. Businesses that choose fixed-rate plans benefit from increased budget certainty and reduced exposure to price spikes. Here are some of the key benefits of selecting a fixed-rate natural gas plan for your business:

- Fixed price per CCF for all gas usage

- Lock-in electric rates for up to 5 years

- Great for budget planning, and financial certainty

Index-Based Gas Plans

A good option for those looking to ride the market.

These types of natural gas plans are especially appealing to businesses that can incorporate natural gas costs into the pricing of their products. Processing facilities and manufacturers of commodity-based goods often benefit from market-based natural gas pricing. For example, a steel manufacturer may prefer to avoid being locked into a high fixed rate when NYMEX market prices drop, as energy costs are a major factor in their production expenses. In these cases, index-based pricing provides flexibility and the opportunity to capture savings when market conditions are favorable. These plans offer a strategic advantage for businesses with cost-sensitive operations.

- Enjoy downturns in the market

- Great when energy market prices are stable

- Good for businesses that treat utility costs as COGS

Fixed + Index Gas Plans

A combination of fixed and NYMEX natural gas rates.

Often preferred by large-scale natural gas users, a hedge + index pricing strategy offers a hybrid approach to managing energy costs. With this setup, businesses can lock in a portion of their expected gas usage at fixed hedge prices while allowing the remainder to follow real-time index pricing. This flexible arrangement helps minimize exposure during periods of high NYMEX market volatility while still enabling cost savings when market prices decline. It’s a strategic solution for businesses seeking both budget stability and market responsiveness. Additional benefits of this structure include:

- Fix gas prices during certain times or seasons

- Float the NYMEX during less-volatile periods

- Enjoy wholesale NYMEX rates for index volumes

Custom Gas Products

A sophisticated alternative for the largest consumers of natural gas.

Commercial organizations can effectively manage their natural gas costs by leveraging advanced financial tools such as options, collars, and hedging strategies.

Options provide the right, but not the obligation, to buy natural gas at a specific price on a future date, offering protection against sudden market spikes without committing upfront.

Collars define a price range by setting both a cap and a floor, creating cost certainty while limiting exposure to extreme volatility.

Hedges allow companies to lock in natural gas prices over a fixed period, helping stabilize expenses and streamline financial forecasting. These strategies are essential for businesses aiming to reduce exposure to natural gas market fluctuations and secure long-term budget reliability.

Get In Touch With Us Today.

Office

- 520 Broad Street, Newark, NJ 07102

Phone

"*" indicates required fields